Automotive Lending

The automotive industry is undergoing a profound and disruptive transformation. As a critical player in the industry, auto finance companies will need to transform their business models to keep in-sync with rapid changes happening all around them. As with most great transformational periods, the ability to adapt quickly in order to optimize opportunities will create winners and losers in the new marketplace. Our solutions help you seize these new opportunities, maximize their potential and optimize your profits. Here are the components of our solutions…

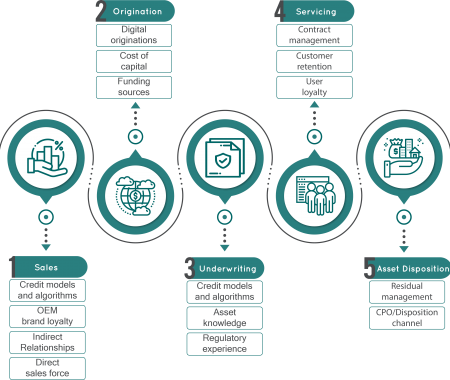

The Value-Added Automotive Financing Lifecycle

Comprehensive Lending and Leasing System

- Built on configurable processes for the complete lending lifecycle, including origination, servicing, collections and asset management

- Predefined finance processes with global best practices optimizing the customer experience

- Robust business rules engine for each business process adhering to the financial institution's internal practices and policies

- A dealer portal for minimizing the effort needed to create and submit a loan application to lenders with the ability to easily track decisions and status

Quick and Consistent Originations

- Allows lenders to accept, process and decision credit applications in a paperless mode

- Delivers quick credit scoring and automated decision making

- Provisions configurable credit guidelines to ensure regulatory compliance

- Supports flexible workflow management for each stage in the lender’s underwriting process

- Provides robust pricing strategies to drive market share and profitability

Streamlined and Fully Integrated Dealer Portal

- Connects dealers and lenders in a fully integrated system

- Modernizes the loan application process with a user-friendly interface

- Enhances the digital experience of dealer salespeople, finance & insurance people, and lenders

- Fully integrates with existing inventory management systems

- Fully integrates with existing document management systems

- Provides an application data entry portal and customizable dashboard

- Provides customizable performance and status reporting

Seamless Servicing

- Allows the lender to manage all customer information in a centralized location

- Simplifies the customer service and management processes with a single source of truth

- Provides a single window into all of a customer’s records to better manage the customer relationship across the lender’s products

- Supports a comprehensive transaction engine to process automated transactions

- Enables better customer service and the processing of customer requests

State of the Art Technology

- A browser-based user interface

- Highly configurable

- Brings together a robust technology platform and extensive experience in the industry

- Supports your business with predefined processes that represent industry best practices

- Cloud-based hosting and deployment

Convenience for All Stakeholders

- Addresses the needs of all participants in the lending and leasing lifecycle

- Improves productivity of staff as a result of its superior operational control and ease of product modification

- Keeps management informed through personalized views of the business

Flexibility of Deployment

- Flexibility of choosing between cloud, hosted, and on-premise deployment or a combination of these

- Cloud offering built on the cloud platform that makes the most sense – Oracle, Azure, AWS, Google, etc.

- Designed specifically for the lending and leasing industry

- Supports seamless data file integration which optimizes performance